Cryptocurrency leverage trading is extremely dangerous, traders who choose to do leverage trading should employ rigorous risk management to their futures trading programs, otherwise they may lose all of their investment and get liquidated. Furthermore, studies have shown that as many as 90% of futures traders lose money, so you should never trade futures with capital you cannot afford to lose.

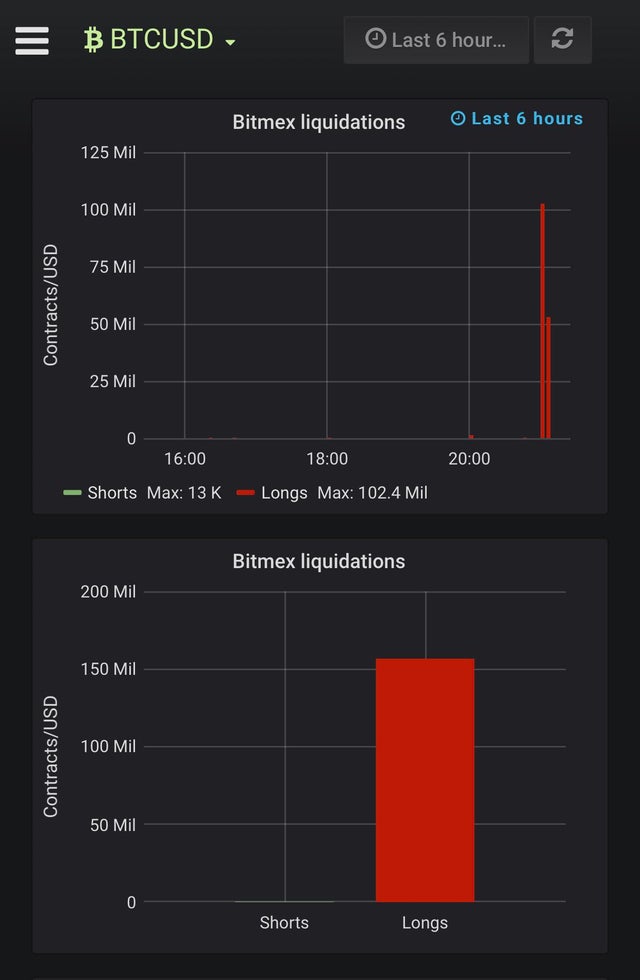

As shown on the above screenshot, Over $150M in longs was liquidated on Bitmex in less than two hours because of the recent BTC price downside.

Cryptocurrency futures trading is often characterized as being similar to gambling or betting horses for a living. There’s no denying that active trading involves risk and potential capital loss. Sometimes Trading is considered gambling because most people don’t understand it and most traders don’t profit from it. The truth is that you are risking something of value in an attempt to make money.

Binance, the world's largest cryptocurrency exchange has announced its plans to delist and pause trading… Read More

LocalMonero, the peer-to-peer exchange platform for the privacy-focused cryptocurrency Monero (XMR), will be shutting down… Read More

The major telecom company Vodafone has unveiled an ambitious plan to integrate cryptocurrency wallets directly… Read More

In the world of cybersecurity, claims of data breaches can cause significant concern and speculation.… Read More

Indian authorities have seized large sum of bitcoins from a resident of Haldwani, a… Read More

A former senior security engineer was sentenced to three years in prison for executing sophisticated… Read More